The cosmetics industry has been through a rollercoaster ride right from the year 2020. Much like the other industries, it was hit hard by the pandemic of Covid-19. As lockdowns were imposed marketers came up with innovative ways to sell their products. Many switched to online operations.

Consequently, most DTC (direct-to-customer) brands and eCommerce owners could successfully sell off their beauty products. The same was a harbinger of profits for manufacturers of innovative cosmetic packaging as they continued investing in the production of unique skincare and lipstick containers. However, the first quarter of 2021 has not been much promising for them. Both import and export sales dipped during the period.

If you are involved in the business of producing unique cosmetic packaging, looking to take major decisions based on the market trends, read on. The article today is all about the cosmetics packaging trends. Draw insights from here to know the status of beauty products and how lucrative is the future for your business.

Figures Denoting the Import & Export Status of Beauty Products

Let’s look at the key highlights of the global cosmetics market below: –

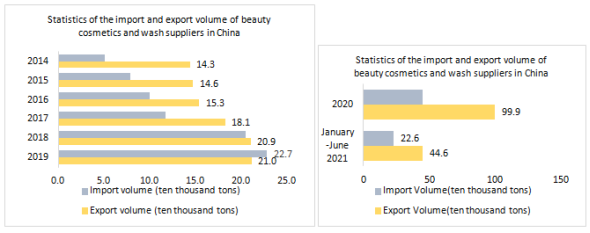

- The import and export statistics of beauty products depict a drop in volume in the first quarter of 2021. The figures came down to almost half of what 2020 had maintained.

- The period 2014 – 2019 had witnessed nothing but a rise in the volume of imports and exports, where the former exceeded the latter. However, imports recorded a drop as compared to exports due to the General Administration of Customs. This occurred in the first half of both 2020 and 2021.

- Expressing in figures, the first half of 2021 recorded a 4.9% increase in import volume as against the previous year’s figures.

- On the contrary, export volume saw a rise of 1.6% in the first six months of 2021 as compared to the year earlier.

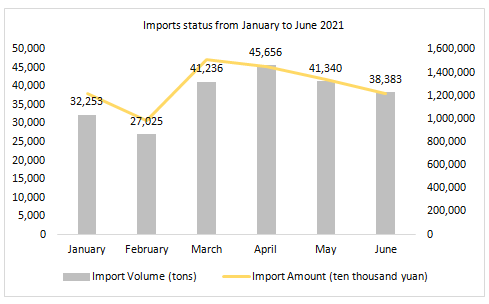

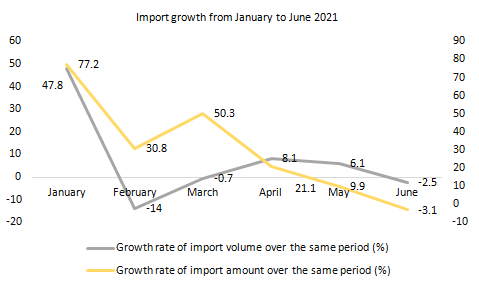

- The growth trend of cosmetics imports suffered another blow on 1stJanuary 2021 as the Cosmetics Supervision and Administration Regulation was implemented. The recurrent outbreak of Covid-19 was another major reason for the decline in import volume and amount. February was even a witness to a negative growth of -14%. Although there was a slight recovery in March and April, you will be surprised to know that the overall trend continues to go down.

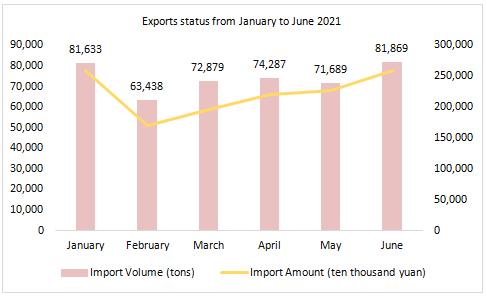

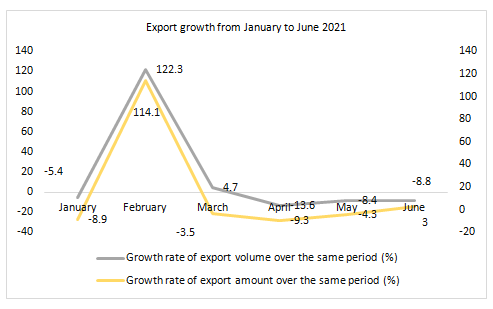

- Surprisingly, China continued to maintain a steady growth trend in cosmetics exports. February was a lucky month as the export volume rose about 122.3% as compared to 2020. Thereafter, the rate stabilized between March to June. This is because the country had managed to bring the epidemic under control with the livelihood stabilizing as opposed to other nations.

Let’s illustrate the discussed data for better understanding: –

[Source: CIRS]

[Source: CIRS]

[Source: CIRS]

[Source: CIRS]

[Source: CIRS]

At present, epidemic prevention and control have been upgraded. New policies have been released. Consumer demand has changed. The cosmetics industry is ready to bounce back by embracing the new trends brought about by the pandemic.

Eye Makeup Demand – A Major Contributor to Cosmetics Industry Growth

Of the many beauty trends that have contributed to a rise in demand for cosmetics, eye makeup is a major player. Since masks continue to conceal the lower portion of everyone’s face, people have shifted their focus to their eyes. The pandemic has been a witness to a doubling up of eye product sales. From mascara, eyeliner, eyebrow gel, eye shadow to eye pencil, experts expect the entire eye market to grow at 6% between 2021 and 2026. There is no wonder why leading makeup brands are currently busy launching new products for eye care! Brands expect to see more growth in the sales of fake lashes and eyeshadows in the upcoming years.

Do you know what is on the rise at the moment? It’s new sustainable packaging prototypes and business models. In a market where almost 91% of the 120B packaging units, generated by the cosmetics industry end up in landfills and oceans, this model was necessary. When millennials and Gen Z customers shifted away from single-use plastics, cosmetic brands had no other option but to shift to recyclable packaging.

The market records almost 70% of US consumers agreeing to pay more for eco-friendly materials used in packaging than the pollution-inducing ones. The government regulation in the EU was another impetus for CPG companies to adopt sustainable alternatives. Take, for instance, the revised goals of the EU in becoming carbon neutral by the end of 2050. Similarly, the European Green Deal has a noble aim to switch to reusable and recyclable packaging by the end of 2030.

Apart from sustainable packaging, biodegradable packing has gained traction in 2021. While Neutrogena has withdrawn from compostable wipes, L’Oréal has introduced new ecologic bottles for all its personal care products. Similarly, many companies are exploring agar, mushrooms, and wood pulp for skincare containers and other beauty products.

2022 – A Year of Regulation for the Cosmetics Industry

The cosmetics industry is up for a change as new regulations and trends are shaping it. Let’s take the case of L’Oréal and similar industry heavyweights, like Henkel, Unilever, and Natura & Co. They have set an industrywide sustainability standard in September 2021, whereby they plan to develop an EIA (Environmental Impact Assessment) and scoring system, taking the entire product life cycle into account. The same will enable shoppers to weigh the impact a cosmetic product would have on the environment.

It is quite clear from the practice that the beauty industry shall have to go through an extensive review of its supply chain. This step will certainly increase the R&D cost of brands, and they may have to experience a negative shadow if they are not transparent about the EIA of their cosmetic products.

Increased regulations on packaging to encourage beauty brands to adopt planet-friendly packaging and meet the sustainability goals of zero-waste packaging by 2021 and 2025, respectively, have already been initiated.

Halal regulations, custom cosmetics, CSAR (Cosmetic Supervision and Administration Regulation), and REACH (Registration, Evaluation and Authorization and Restriction of Chemicals) regulations are others affecting the cosmetics industry.

Ending Thoughts:

Are you an innovative lipstick container manufacturer? Do you design and develop unique skincare containers? In simple words, are you into innovative cosmetic packaging? The future is bright for you if you have invested in sustainable products and supply them mostly to eye makeup brands. If you are still lagging on those fronts, pull up your socks and get going. Success is not far away!